BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

मानव संसाधन प्रबंधन ववभाग

Human Resources Management Department

प्रधान कार्ाालर्: लोकमंगल, 1501, शिवाजीनगर, पुणे5-

Head Office: LOKMANGAL,1501,SHIVAJINAGAR,PUNE-5

टेलीफोन/TELE-020 : 25614321-477

ई/मेल-e-mail : [email protected]

AX1/ST/RP/Officers in Scale II/Phase I/2025-26 Date: 13.08.2025

Recruitment Notification

Recruitment of Officers in Scale II – Project 2025-26

Date of submission of online application starts from 13

th Aug 2025 to 30th Aug 2025

BANK OF MAHARASHTRA, a leading Public Sector Bank, Public Sector Bank with its Head Office in Pune and

a network of over 2,600 branches across the country, is expanding its business and national footprint. The Bank

is looking for motivated professionals / officers for its leadership roles at Branches. The Bank invites online

applications from candidates for recruitment of Generalist Officers in Scale II.

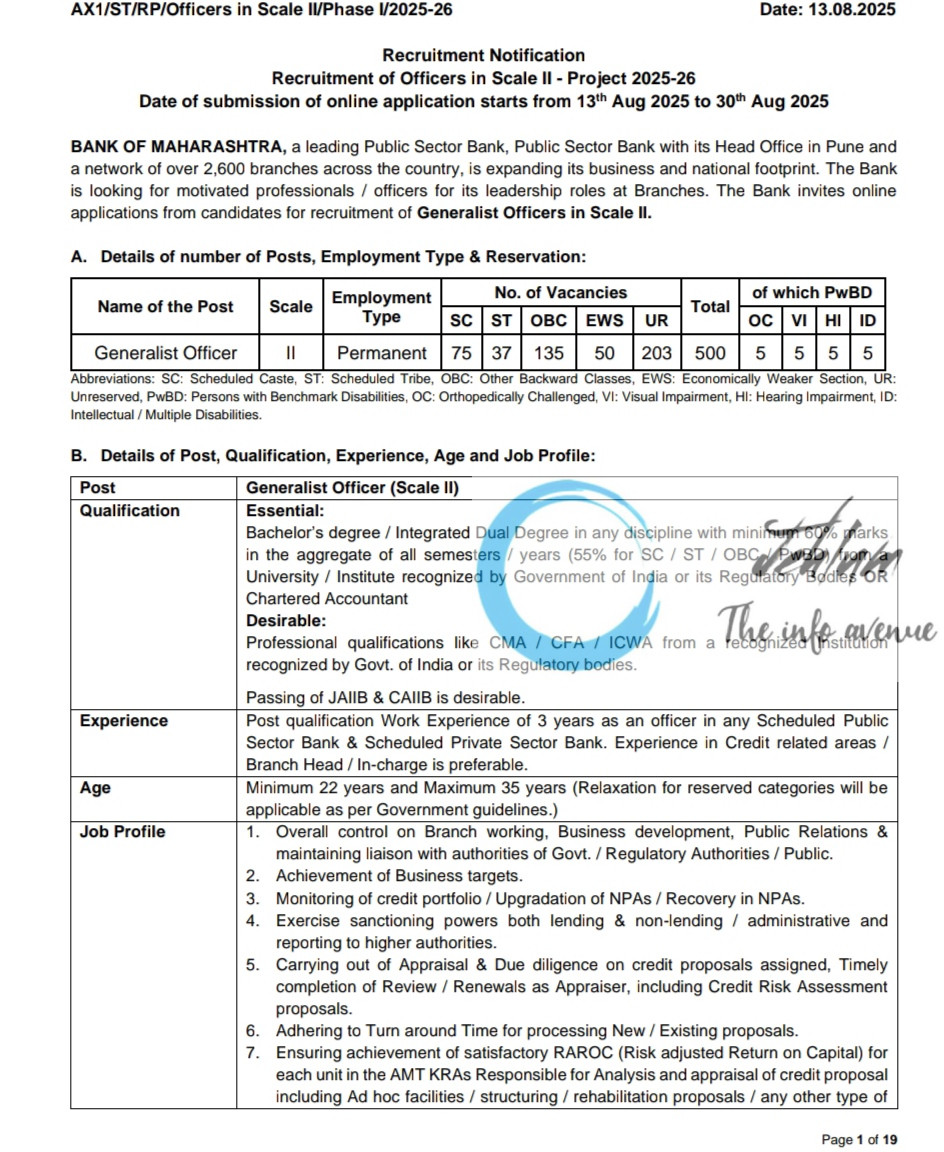

A. Details of number of Posts, Employment Type & Reservation:

Name of the Post Scale Employment

Type

No. of Vacancies

Total

of which PwBD

SC ST OBC EWS UR OC VI HI ID

Generalist Officer II Permanent 75 37 135 50 203 500 5 5 5 5

Abbreviations: SC: Scheduled Caste, ST: Scheduled Tribe, OBC: Other Backward Classes, EWS: Economically Weaker Section, UR:

Unreserved, PwBD: Persons with Benchmark Disabilities, OC: Orthopedically Challenged, VI: Visual Impairment, HI: Hearing Impairment, ID:

Intellectual / Multiple Disabilities.

B. Details of Post, Qualification, Experience, Age and Job Profile:

Post Generalist Officer (Scale II)

Qualification Essential:

Bachelor’s degree / Integrated Dual Degree in any discipline with minimum 60% marks

in the aggregate of all semesters / years (55% for SC / ST / OBC / PwBD) from a

University / Institute recognized by Government of India or its Regulatory Bodies OR

Chartered Accountant

Desirable:

Professional qualifications like CMA / CFA / ICWA from a recognized Institution

recognized by Govt. of India or its Regulatory bodies.

Passing of JAIIB & CAIIB is desirable.

Experience Post qualification Work Experience of 3 years as an officer in any Scheduled Public

Sector Bank & Scheduled Private Sector Bank. Experience in Credit related areas /

Branch Head / In-charge is preferable.

Age Minimum 22 years and Maximum 35 years (Relaxation for reserved categories will be

applicable as per Government guidelines.)

Job Profile 1. Overall control on Branch working, Business development, Public Relations &

maintaining liaison with authorities of Govt. / Regulatory Authorities / Public.

2. Achievement of Business targets.

3. Monitoring of credit portfolio / Upgradation of NPAs / Recovery in NPAs.

4. Exercise sanctioning powers both lending & non-lending / administrative and

reporting to higher authorities.

5. Carrying out of Appraisal & Due diligence on credit proposals assigned, Timely

completion of Review / Renewals as Appraiser, including Credit Risk Assessment

proposals.

6. Adhering to Turn around Time for processing New / Existing proposals.

7. Ensuring achievement of satisfactory RAROC (Risk adjusted Return on Capital) for

each unit in the AMT KRAs Responsible for Analysis and appraisal of credit proposal

including Ad hoc facilities / structuring / rehabilitation proposals / any other type of

business or general proposal pertaining to the unit. Ensuring timely / review/renewal

of credit limits.

8. Ensuring compliance of KYC norms. Submission of periodical due diligence reports

as per RBI guidelines.

9. Obtaining data/information from customers for assessment and processing of the

proposal. Interacting with key officials in the borrowing units for obtaining

data/statements etc.

10. Organising Customer Meets, Supervise job rotation.

11. Follow up of inspection & audit reports & ensuring rectifications. All correspondence

relating to Head Office, Zonal Office, Redressal of complaints.

12. Overall control of Branch/Record maintenance. Ensuring that the Bank’s systems &

procedures are properly followed at the Branch.

13. Giving greater attention to planning for business development, charting strategies

for growth, expanding customer base through requisite customer relationship

measures, scouting for avenues to expand credit portfolio qualitatively &

quantitatively, Management of NPAs, Liaison with local authorities, Govt.

departments, Large Institutions, Corporates & high net worth clients etc. to ensure

that the Branch is on the path of accelerated growth & improves market share.

14. Maintaining effective Public Relations and ensure courtesy in dealing with the

customers and public in person, in correspondence and on telephone. Avoid

confrontation by resolving the issues tactfully.

15. Ensure adherence to Telephone Discipline by all the members of staff. Maintaining

effectiveness in branch operations and in customer service. Dispose the matters as

per the rules in force except those that require the personal attention of the Branch

Manager.

16. Redressal of the grievances of customers as per rules / guidelines duly bringing to

the notice of the Branch Head unpleasant instances, if any, happened in his

absence.

17. Ensure maintenances of adequate stock of security items, passbooks, publicity

literature and various forms required for deposits & advances and other transactions.

18. Monitoring the matters related to claims to the assets of the deceased customers

and ensuring their quick disposal as per prevalent guidelines. Be aware and

authorize the return of cheques of customers in the absence of Branch Head and

ensure to bring the same to the notice of the Branch Head.

19. Attend to effective cash management. Joint custody of cash, Supervision over

tallying cash, physical [from docket & cash reports in system], Authorize cash

transactions, authorizing transactions within his powers, ensure smooth Day-begin,

Day-end of the branch software systems, Verify & ensure prompt submission of

periodical returns in conformity with the prescriptions in schedule of returns through

concerned departmental Officers / Staff. Ensure periodical balancing / tallying of

books of accounts and monitoring of fraud prone sundry items as prescribed.

20. Scrutiny of daily vouchers, verification, protection and preservation of voucher

bundles and records in use. Assisting in segregation and destruction of old records

as per the policy after obtaining permission from the competent authority.

21. Monitor preparation of annual indent of stationery and security items as per norms.

Monitor and maintain close watch on current accounts, big accounts, newly opened

accounts and other institutional accounts which form sizable share in total deposits.

Ensure maintenance of registers for cash transactions exceeding Rs. 10.00 lacs and

observations of KYC norms at the time of opening of accounts and monitoring of

large value transactions.

22. Ensuring Security measures for security of branch premises, Safe Vaults & Bank

property.

23. Operations & Record maintenance for Safe Deposit Lockers.

24. Ensure periodical verification of securities and attend to orderly arrangement of joint

custody items duly getting relevant registers updated as a joint custodian. Facilitate

taking note of exceptions appearing in exceptional reports by Branch Head and

enforce steps to reduce such items.

25. Take steps to plug loopholes in transgressions on systems and procedures or unfair

practices that may cause operational risks / future losses. Advise the staff to adhere

to the laid down systems and procedures and to avoid shortcuts bypassing the

guidelines. Ensure maintenance of mandatory registers like customer complaint

register, AOD registers etc.

26. Ensure compliance of Bank’s Policy & guidelines. Timely submission of reports to

reporting authority.

The above roles & responsibilities are indicative and bank at its own discretion may

assign KRA or other Roles as per business needs.

C. Note:

1. The above number of vacancies are provisional and may vary according to actual requirement of the

Bank, subject to availability of suitable candidates.

2. The candidates belonging to the reserved category are free to apply for vacancies announced for

unreserved categories. However, they must fulfil all the eligibility conditions of unreserved category.

3. The selected candidates will be posted anywhere in India, depending on the requirement of the Bank.

The job role / description is only indicative and not exhaustive; applicants must fulfil their duties in

accordance with the tasks that will be given to them.

4. The cut-off date for Eligibility Criteria and other details is 31.07.2025.

5. Before applying, candidates are requested to ensure that they fulfill the eligibility criteria for the post as

on the date of eligibility. The process of registration is complete only when fee is deposited with the

Bank through online mode on or before the last date of payment of fee.

6. Candidates are advised to check Bank’s website regularly for details and updates. No separate intimation

/ advertisement etc. will be issued in case of any change / update.

7. Vacancies reserved for OBC category are available only to the ‘Non-creamy layer’ OBC candidates.

‘Creamy layer’ OBC candidates should indicate their category as ‘General’.

8. Vacancies for PwBD category candidates are reserved horizontally. @ PWBD categories under clauses

‘d’ & ‘e’ of Section 34(i) of RPWD Act 2016 – (i) “Specific Learning Disability” (SLD); (ii) “Mental Illness”

(MI); (iii) “Multiple Disabilities” (multiple disabilities amongst LD, VI, HI, SLD & MI).

9. Reservation for Economically Weaker Section (EWS) in recruitment is governed by Office Memorandum

no. 36039/1/2019-Estt (Res) dated 31.01.2019 of Department of Personnel & Training, Ministry of

Personnel, Public Grievance & Pensions, Government of India. Benefit of reservation under EWS

category can be availed upon production of an ‘Income and Asset Certificate’ issued by a Competent

Authority on the format prescribed by Government of India.

10. Reservation for Persons with Benchmark Disabilities (PwBD): 4% horizontal reservation has been

provided to Persons with Benchmark Disabilities as per section 34 of “Rights of Persons with Disabilities

Act, 2016”.

11. Candidates with record of default in repayment of loans/ credit card dues and/ or against whose

name adverse report of CIBIL or other external rating agencies is available are not eligible for

appointment. Candidates against whom there is / are adverse report regarding character &

antecedents, moral turpitude are not eligible to apply for the post. Candidates who have been

found guilty in any departmental investigation are ineligible for the positions.

12. Candidate should be proficient in computers, good in inter-personal communication skills, analytical skills

and drafting skills.

13. The appointment of officers is on PAN India basis and the selected candidates are liable to be posted

anywhere in India as a Branch Manager / Officer as per Bank’s requirement.

14. Only full-time experience as a permanent employee after acquiring the educational qualification will be

considered. Candidates having work experience as contractual employee are not eligible for the posts.

15. The date of passing eligibility examination will be the date appearing on the mark sheet or provisional

certificate issued by the University/ Institute. In case the result of a particular examination is posted on

the website of the University/ Institute, a certificate issued by the appropriate authority of the University/Institute indicating the date on which the result was posted on the website will be taken as the date of

passing.

16. Candidate should indicate the percentage obtained in Graduation calculated to the nearest two decimals

in the online application. Where CGPA/ OGPA is awarded, the same should be converted into percentage

and indicated in the online application. If called for interview, the candidate will have to produce a

certificate issued by the appropriate authority inter alia stating the norms of the University

regarding conversion of grade into percentage and the percentage of marks scored by the candidate

in terms of these norms.

17. Calculation of Percentage: The percentage marks shall be arrived at by dividing the total marks obtained

by the candidate in all the subjects in all the semester(s)/ year(s) by total maximum marks in all the

subjects irrespective of honours /optional/ additional optional subject in all the semester(s)/ year(s). This

will be applicable for those Universities also where Class/ Grade is decided on basis of Honours marks

only. The fraction of percentage so arrived will be ignored i.e. 59.99% will be treated as less than

60%.

18. In case of any candidate completed the Diploma Course and directly got entry into second year / semester

in degree course by getting exemption of few semesters / years’ then only those semesters / years’ marks

would be considered which are part of bachelor’s degree, neither diploma marks nor any exempted

semesters/ years’ marks shall be considered for eligibility. The same shall also be applicable for other

degree courses.

Applications once submitted will not be allowed to withdraw and fee once paid will not be refunded on any

ground nor can it be held in reserve for any other examination or selection. Eligible candidate has to apply

online through the Bank’s website www.bankofmaharashtra.in only. No other means/ mode of

application is acceptable.

R. Application procedure:

1. Candidates are advised to go to the Bank’s website www.bankofmaharashtra.in and click on the ‘Careers

→ Recruitment Process → Current Openings to open the link “Online application for recruitment of

“Recruitment of Officers in Scale II ~ Project 2025-26” and then click on the option “APPLY ONLINE”

which will open a new screen.

2. To register application, choose the tab “Click here for New Registration” and enter Name, contact details

and e-mail id. A Provisional Registration Number and Password will be generated by the system and

displayed on the screen. Candidate should note down the Provisional Registration Number and Password.

An Email & SMS indicating the Provisional Registration number and Password will also be sent.

3. Visually Impaired candidates should fill the application form carefully and verify / get the details verified to

ensure that the same are correct prior to final submission.

4. Candidates are advised to carefully fill and verify the details filled in the online application themselves as

no change will be possible / entertained after clicking the COMPLETE REGISTRATION Button.

5. The Name of the candidate or his / her father / husband etc. should be spelt correctly in the application as

it appears in the Certificates / Mark sheets. Any change/alteration found may disqualify the candidature.

6. Validate your details and Save your application by clicking the Validate your details’ and ‘Proceed’ button.

7. Candidates can proceed to upload Photo, Signature, Left Thumb Impression & Handwritten Declaration

as per the specifications given in the Guidelines for Scanning and Upload of Photograph and Signature.

8. Candidates can proceed to fill other details of the Application Form.

9. Click on the Preview Tab to preview and verify the entire application form before COMPLETE

REGISTRATION.

10. Modify details, if required, and click on ‘COMPLETE REGISTRATION’ ONLY after verifying and ensuring

that the photograph, signature uploaded and other details filled by you are correct.

11. Candidates are requested to apply on-line between 13.08.2025 and 30.08.2025.

Particulars Date

Commencement date of on-line application 13.08.2025

Last Date of online application 30.08.2025

Date of Online Examination Will be informed separately

Date of GD / Interview Will be informed separately

12. Payment of fees:

a. Candidates have the option of making the payment of requisite fees / intimation charges through the

ONLINE mode only. Payment of fees / intimation charges through the ONLINE MODE from 13

th Aug

2025 to 30th Aug 2025. No other mode of payment is acceptable.

b. After ensuring the correctness of the particulars of the application form, candidate should pay fees

through the payment gateway integrated with the application, by following the instructions available

on the screen. The payment can be made by using debit card / credit card / Internet Banking by

providing information as asked on the screen. Transaction charges for online payment, if any, will be

borne by the candidates.

c. On successful completion of the transaction, e-receipt and application form will be generated which

may be printed for record. The printout of the application form should not be sent to the Bank.

d. If the online transaction is not successfully completed, please register again and make payment online.

There is also a provision to reprint the e-Receipt and Application form containing fee details, at later

stage.

S. Procedure for Uploading Document/s: – The candidates should upload each listed document at the time of

online application. There will be separate links for uploading each document.

General Information:

1. Candidates are advised to take a printout of their system generated online application form after

submitting the application.

2. Candidates should satisfy themselves about their eligibility for the post applied for. The Bank would admit

to the test all the candidates applying for the posts with the requisite fee on the basis of the information

furnished in the online application and shall determine their eligibility at the time of interview and may

verify thereafter at every stage of recruitment.

3. Candidates are advised in their own interest to apply online well before the closing date and not to wait

till the last date to avoid the possibility of disconnection/ inability/ failure to log on to the website on account

of heavy load on internet or website jam.

4. Bank of Maharashtra does not assume any responsibility for the candidates not being able to submit their

applications within the last date on account of aforesaid reasons or for any other reason beyond the

control of Bank of Maharashtra.

5. Not more than one application should be submitted by a candidate. In case of multiple applications, only

the last valid (completed) application will be retained and the application fee/ intimation charges paid for

the other registrations will stand forfeited. Multiple attendance/ appearance by a candidate in examination/

interview will result in summary rejection/ cancellation of candidature.

6. The possibility of occurrence of some problems in administration of examination cannot be ruled out

completely, which may impact test delivery/ generation of result. In such cases, every effort will be made

to resolve the problem, which may include the conduct of another examination if considered necessary.

7. In case of selection, candidates will be required to produce proper discharge certificate from the employer

at the time of taking up the appointment.

8. The original documents regarding eligibility criteria and proof of date of birth should be produced for

verification on the date of interview. Candidate will not be allowed to attend the interview if original

certificates are not produced for verification on the date of interview.

9. Caste certificate issued by Competent Authority on the format prescribed by the Government of India will

have to be submitted by the SC/ ST /OBC/EWS candidates, if called for interview.

10. A declaration will have to be submitted in the prescribed format by candidates seeking reservation under

OBC category stating that he/ she does not belong to the Creamy Layer.

11. Benefit of reservation under EWS category can be availed upon production of an ‘Income and Asset

Certificate’ issued by a Competent Authority on the format prescribed by Government of India.

12. Candidates are advised to keep their e-mail ID alive for receiving advices / communications.

13. The Job Profile / Job role is indicative not exhaustive.

14. As record for this project will not be maintained after one year on declaration of result of online test, the

information / data regarding this project will not be available thereafter.

15. After a candidate is selected but before joining the Bank, the candidate will be required to provide details

regarding criminal case(s) pending against him /her, if any. The Bank may also conduct independent

verification, inter alia including verification of police records etc. The Bank reserves right to deny the

appointment depending upon such disclosures and/or independent verification.

16. Any legal proceedings in respect of any matter of claim or dispute arising out of this advertisement and/

or an application in response thereto can be instituted only in Pune and Courts/ Tribunals/ Forums at

Pune only shall have sole and exclusive jurisdiction to try any cause/ dispute. Bank reserves right to

change / modify / cancel the recruitment process at any stage fully or partly on any grounds and such

decision of the Bank will not be notified or intimated to the candidates.

17. The cut-off date for Post qualification experience will be given in this notification. Only full-time

experience as a permanent employee after acquiring the educational qualification notified for eligibility

will be considered. The candidate must provide the proof of the claimed work experience. The experience

certificate(s) for the period given in the online application should be issued on the prescribed format (The

prescribed format of Experience certificate is available as Annexure-III with this notification) unde

signatures of the Competent Authority at the Controlling Office / Head Office level of the respective

employer/s, clearly stating the period, Post(s) held and nature of duties performed by the applicant.

The copies of the Appointment Letters, Salary Certificates, pay slip etc. will not be accepted in

lieu of Work Experience Certificate. The applicant will not be allowed to participate in the process on

the basis of Appointment Letters, Salary Certificates, Pay slip etc. His / Her candidature shall be cancelled

at any stage, even after his / her selection / appointment in the services of the Bank on the basis of

Appointment Letters, Salary Certificates, Pay slip etc.

18. The applicants will be called for the Online Examination / Group Discussion (if conducted) / Interview, on

the basis of the information provided by them in their Online Applications without verification of their age

or qualification or category or any other eligibility criteria. The applicants must, therefore, ensure that they

fulfil all the notified eligibility criteria as on the cut-off date prescribed in this notification, have possession

of the requisite documents / certificates specified by the Bank, and that the particulars furnished in their

Online Application are complete, true and correct in all respects.

Merely appearing in the Online Examination / Interview or passing the Online Examination / Interview and

/ or being called by the Bank for the Interview shall not imply that the Bank is satisfied about the eligibility

of the applicant. Bank may verify the eligibility of the candidates at any stage of recruitment or thereafter

and reserves right to terminate the service of provisionally selected candidates if found ineligible for the

post.

19. The Bank reserves the right to alter, modify or change the eligibility criteria and / or any of the other terms

and conditions spelt out in this Notification.

20. Candidates should mention all the qualifications and experience in the relevant field over and above the

minimum one suggested herein above and should attach attested copies of the certificates in support

thereof. The Bank reserves the right to call only the requisite number of candidates for the Group

discussions/interview after preliminary screening /short listing with reference to candidate’s qualifications

/ suitability and experience etc.

21. The Bank reserves the right to change / modify the selection procedure / hold supplementary process, if

necessary. The changes, if any shall be intimated to the candidates through Bank’s website / registered

e-mail in advance. When called for Group Discussions (GD) and / or Interview, candidates have to bring

original of documents for verifications. Candidates will not be allowed to participate GD and / or Interview

without production of the original documents.

22. The candidate called for online examination / GD / Interview will be informed through Bank’s

website/registered e-mail/SMS as per information provided by them in the application. Though

bank puts maximum efforts to send the communication by e-mail/SMS, if any candidate does not

receive the same due to technical or any other reasons, bank shall not be responsible for non-

receipt of communication. The candidates are advised to visit Bank’s website frequently for

updates.

23. The Candidates should ensure that they fulfil all eligibility criteria. Their candidature at all the stages of

recruitment process will be purely provisional subject to satisfying prescribed eligibility criteria mentioned

in this advertisement.

24. The above number of vacancies are provisional and may vary according to actual requirement of the

Bank, subject to availability of suitable candidates. The candidates belonging to reserved category are

free to apply for vacancies announced for unreserved categories. However, they must fulfil all the eligibility

criteria of unreserved category.

25. If any false/incorrect information furnished by the candidate is detected at any stage of recruitment

process, he/she will be disqualified from the selection process and liable to terminate the services, if

appointed.

26. If the candidate knowingly or wilfully furnishes incorrect or false particulars or suppresses material

information, he/she will be disqualified and if appointed, shall be liable for dismissal from the Bank’s

service without any notice or assigning any whatsoever reasons.

27. The decision of the Bank in all matters relating to recruitment shall be final and no individual

correspondence will be entertained. Applications received after due date will not be entertained. The

Bank is not responsible for any technical or other reasons or delay.

The recruitment in Bank of Maharashtra is done strictly as per merit in a systematic way. Canvassing in

any form will disqualify the candidate.

29. The Bank reserves the right to cancel the Recruitment at any stage through this Advertisement fully or

partly on any grounds and such decision of the Bank will not be notified or intimated to the candidates.

30. The application must be submitted on-line through Bank`s website www.bankofmaharashtra.in.

31. Appointment of selected candidate is subject to his/her being declared medically fit as per the requirement

of the Bank. Such appointment will also be subject to the Service & Conduct Rules of the Bank.

32. The selected candidate will be on probation and after completion active service from the date of joining.

Their confirmation in the Bank`s service will be decided in terms of the provision of the Bank of

Maharashtra (Officers) Service Regulations.

33. Candidates applying under reserved category should submit the related certificates in the format

prescribed by the Government of India. Relaxation in age will be given to the reserved category

candidates as per extant guidelines of Government of India.

34. Online Application will not be registered unless you upload your Photograph, signature, left thumb

impression and handwritten declaration as specified.

35. The candidates against whom any Disciplinary Action is / was initiated and minor / major punishment is /

was imposed, such candidates are not eligible to apply for any post.

36. During the examination, at any stage, if it observed that the scribe is independently answering the

questions or violating the guidelines, the exam session may be terminated and candidate’s candidature

will be cancelled. The candidature of such candidates using the services of scribe will also be cancelled

if it is reported / transpired after the examination by the test administrator that the scribe independently

answered the questions.

Z. Announcements:

All further announcements/ details pertaining to this process will be published/ provided only on

www.bankofmaharashtra.in from time to time. No separate advertisement will be issued in this regard.

AA.Disclaimer:

In case it is detected at any stage of recruitment that a candidate does not fulfil the eligibility norms and/ or

that he/ she has furnished any incorrect/ false information or has suppressed any material fact(s), his/ her/

their candidature will stand cancelled.

If any of these shortcomings is/ are detected even after appointment, his/ her/ their services are liable to be

terminated. Decisions of bank in all matters regarding eligibility, conduct of online examination / other tests/

selection would be final and binding on all candidates. No representation or correspondence will be

entertained by the Bank in this regard.

For more details, please visit bank’s website (www.bankofmaharashtra.in). Online applications for submission

shall be open from 13.08.2025 to 30.08.2025. Before applying candidates are advised to ensure that they

fulfil the stipulated eligibility criteria as per the details on bank’s website. Helpdesk: In case of any problem in

filling up the form, payment of fee / intimation charges or receipt of Admission/ call letter, queries may be

lodge on email [email protected] / [email protected]. Candidates should mention

‘Recruitment of Officers in Scale II in Bank of Maharashtra 2025-26’ in the subject of the email.

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

BANK OF MAHARASHTRA JOB OPPORTUNITIES NOTIFICATION 2025

N.B: Please don’t apply using the form given below. Check instructions above on how to apply for this job opening.